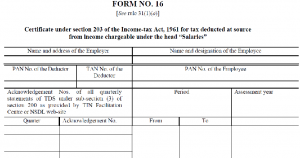

Once you start earning, there comes a time when you will be handed over Form 16 by your employer. It is rather a new and uneducated part of earning for many and very few have knowledge of it. While tax returns and filling up forms can look complex, it is actually quite simple. A glance at the form shows two parts, Part A & B making a total of 4 pages. Form 16 is a certificate available under Section 203 of the Income tax, 1961 for tax deducted at source on salary. The form consists of details of tax deducted by your employer. This form is also useful for filing Income Tax Returns.

Breakdown of Form 16

In Part A, you will have to fill out simple details like Name and address of Employer, Name and address of Employee, PAN of the deductor, TAN (Tax deduction Account Number) of the deductor and PAN of the employee. It also asks for details of TDS (Tax Deducted at Source), it is the tax that your employer deducts every month and transfers it to the Income Tax department. For example, if you are being deducted an amount of Rs. 2000 every month, your Form 16 will show this amount as deposited by your employer. Your employer can choose to send this amount on a quarterly basis or half yearly which will be shown. It also asks for further details like Assessment year and Period with the employer.

In Part B, mention your Gross salary and in deductions that come under 80C, 80CCC and 80 CCD make sure that all the investments (Life insurance, Public Provident Fund etc.) is not more than 1 lac rupees. Mention deductions like 80 E, 80G, 80TTA for Educational loan, donations etc. The total of all the deductions are reduced from the gross salary and the remaining income is taxed.

Details to note before submitting:

Form 16 is issued by your employer; make sure that your income, loan and investment details are mentioned correctly. If there is an error, you can get it changed from your employer. This applies to only to your salary. If you have other sources of income, then you will have to submit forms related to it. For example, if you are receiving interest from your savings account then you will have to submit Form 16A.

Checking your tax details:

You can check if your employer has paid the tax using the Form 26 AS. It also applies to the bank and institutions that provide you income. This form can be obtained from the Income Tax department?s website. In case you have changed employers, then you will have to fill up 2 forms of Form 16 and submit them.

E-filing tax returns:

When your income after deductions is more than 2 lac rupees then you will have to file for tax returns. Even if it is below the said 2 lac rupees, you are still liable to file IT returns. If the amount is more than 5 lac rupees, then you must E-file your IT returns. This can be done by filling the form from IT department website. You will have to provide your PAN card details and your bank account number in case a Tax Refund (from excess tax) needs to be credited to your account. You will have to file your IT returns by July 31, 2016 for the year ended March 31, 2016.